Gonen Funds Exchange™

Designed to be high-impact, professional, and visually aligned with the tech-forward aesthetic.

Pitch Deck Outline: Gonen Funds Exchange™

Slide 1: The Title

- Visual: The Gonen Funds circular logo on a dark, sleek background.

- Text: Gonen Funds Exchange™: The Future of Asset-Backed Investment.

- Subtext: Bridging Private Capital with Institutional-Grade Real Estate & Business Assets.

Slide 2: The Opportunity (The “Why”)

- The Problem: Traditional real estate and private equity markets are opaque, illiquid, and restricted by “gatekeeper” barriers.

- The Gap: High-net-worth individuals and private funds often lack direct, compliant pathways to participate in mid-to-large scale syndications.

- The Market: Mention the trillions of dollars moving into “alternative assets” and the rise of decentralized finance (DeFi) principles in traditional real estate.

Slide 3: The Solution

- The Platform: A centralized exchange that simplifies PPM (Private Placement Memorandum) funding and Equity Crowdfunding.

- The Tech: A streamlined interface for capital aggregation, compliance tracking, and asset management.

- The Result: Fractionalized ownership in high-value assets with institutional-grade oversight.

Slide 4: Key Asset Pillars

- Real Estate Holdings: Residential developments, commercial portfolios, and industrial land.

- Business Assets: Private equity in scaling enterprises and distressed asset acquisitions.

- Strategic Growth: Funding for infrastructure and technology-driven physical assets.

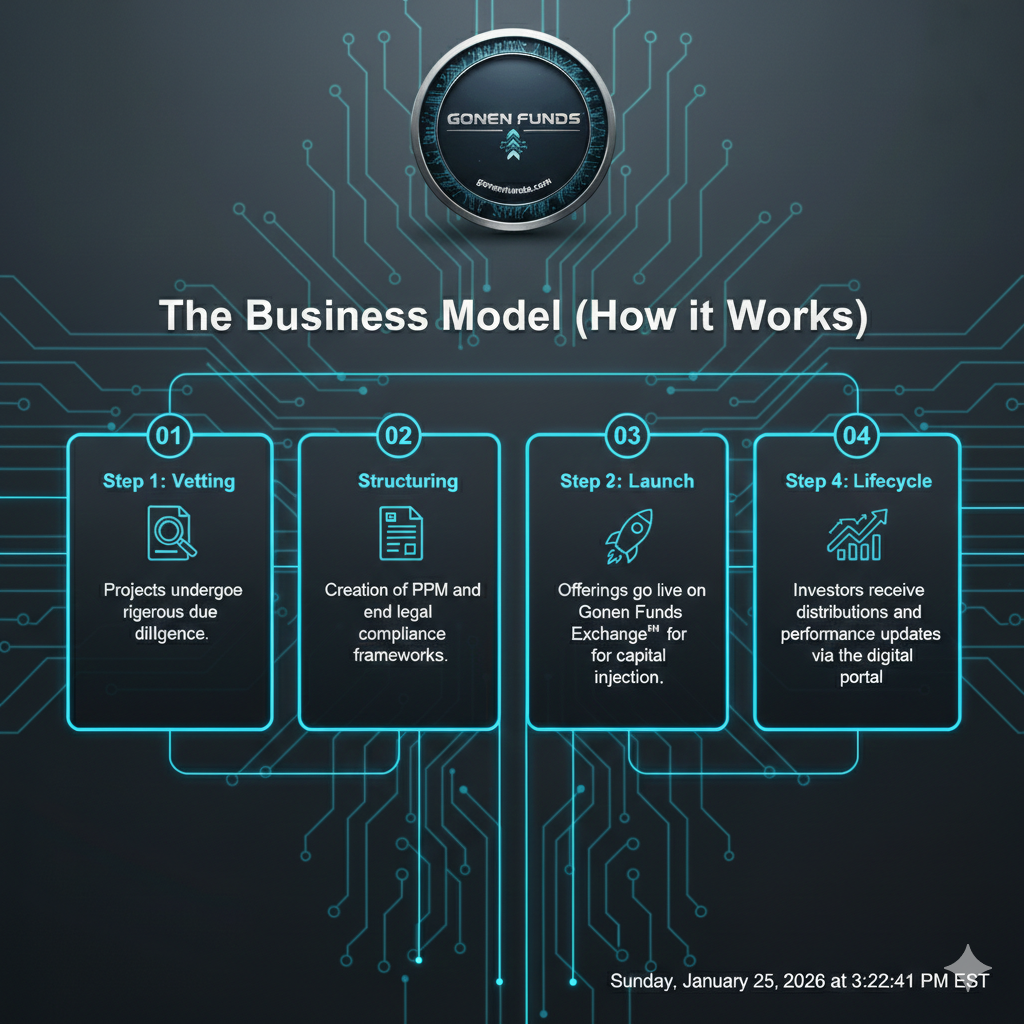

Slide 5: The Business Model (How it Works)

- Step 1: Vetting. Projects undergo rigorous due diligence.

- Step 2: Structuring. Creation of PPM and legal compliance frameworks.

- Step 3: Launch. Offerings go live on the Gonen Funds Exchange™ for capital injection.

- Step 4: Lifecycle. Investors receive distributions and performance updates via the digital portal.

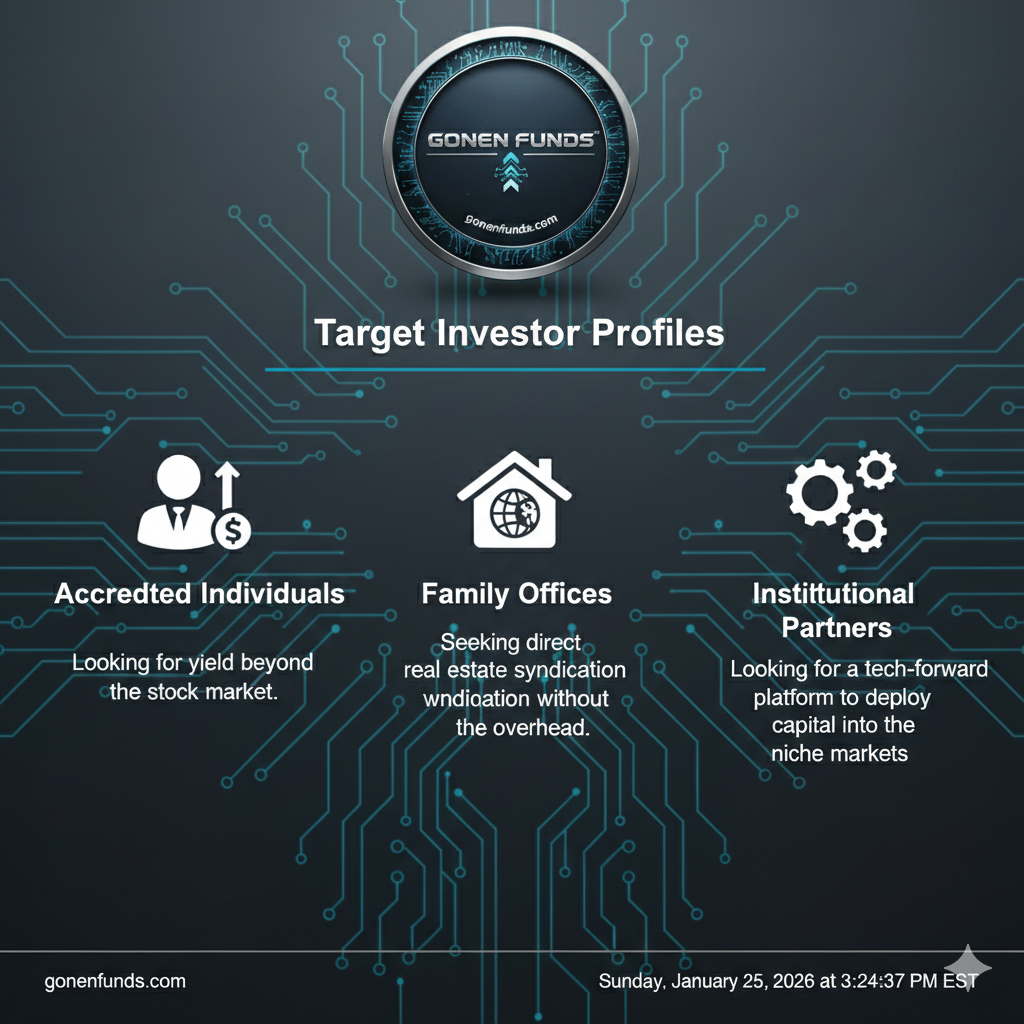

Slide 6: Target Investor Profiles

- Accredited Individuals: Looking for yield beyond the stock market.

- Family Offices: Seeking direct real estate syndication without the overhead.

- Institutional Partners: Looking for a tech-forward platform to deploy capital into niche markets.

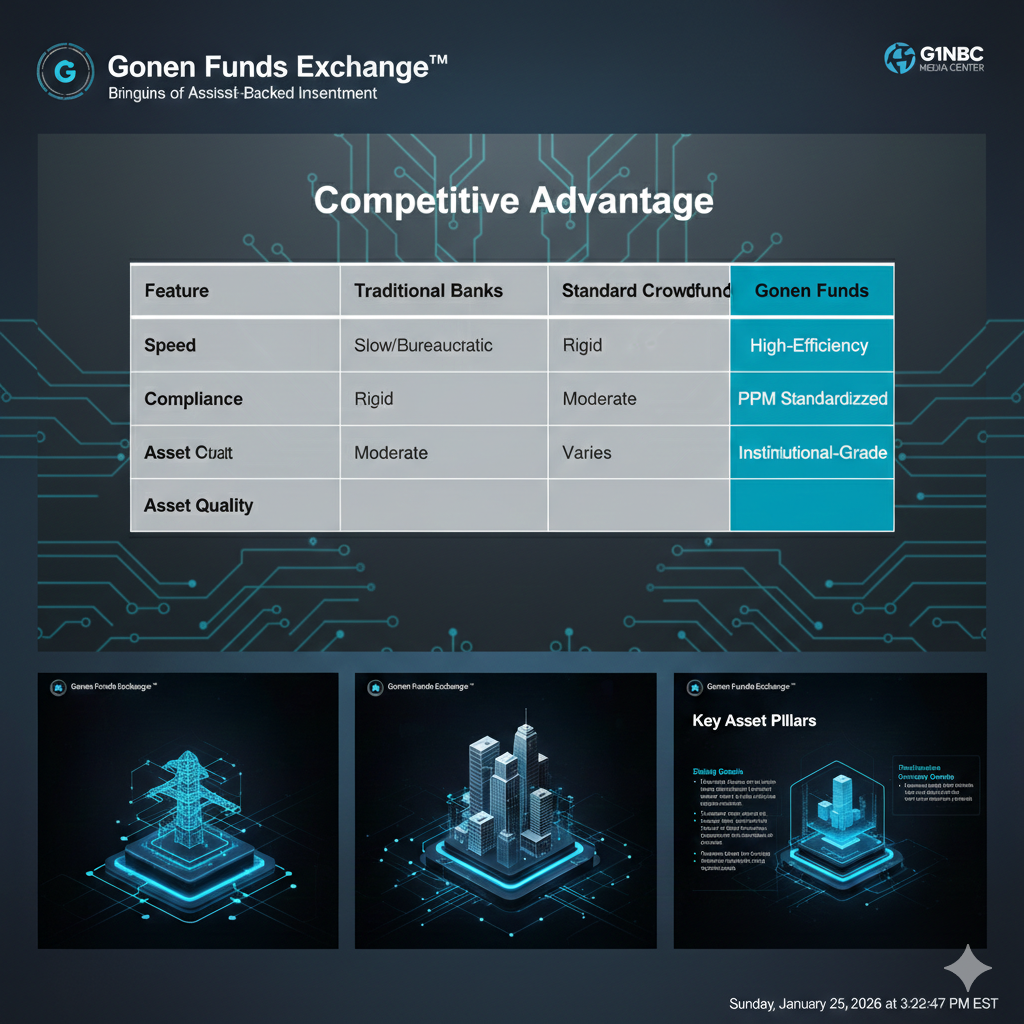

Slide 7: Competitive Advantage

| Feature | Traditional Banks | Standard Crowdfund | Gonen Funds |

|---|---|---|---|

| Speed | Slow/Bureaucratic | Moderate | High-Efficiency |

| Compliance | Rigid | Varies | PPM Standardized |

| Asset Quality | General | Often Retail | Institutional-Grade |

Slide 8: The Roadmap

- Phase 1: Platform launch & initial Real Estate seed funding (Current).

- Phase 2: Expansion into cross-border business asset crowdfunding.

- Phase 3: Secondary market integration for equity liquidity.

Slide 9: Call to Action

- Headline: Secure Your Place in the Future of Exchange.

- Contact Info: [Email Address] | [Website URL] | [QR Code for Prospectus]